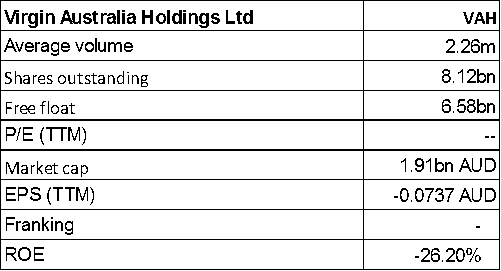

Virgin Australia Holdings Ltd

VAH Details

Strategic partnership updates:Virgin Australia Holdings Ltd (ASX: VAH) has announced for the completion of A$89 million placement to HNA Innovation Ventures. VAH and Alliance Airlines Services Limited have signed a long-term strategic partnership agreement, which was subject to approval from the Australian Competition and Consumer Commission. Both would form a charter partnership to jointly grow their charter businesses. They would offer and procure services for each other on a preferential basis. Moreover, VAH has welcomed the ACCC’s draft determination of approving the reauthorization of its alliance with Singapore Airlines for five years. The group also plans to launch new Perth-Abu Dhabi services and resume nonstop flights between Melbourne and Los Angeles.

.png)

FY16 Results (Source: Company Reports)

On the other hand, VAH financial performance is still a concern as the group reported a statutory loss after tax of $224.7 million for the FY 16 despite falling oil prices. As a result, VAH stock fell over 40.26% in the last six months (as of September 21, 2016) and still we believe the pressure would continue. Accordingly, we give a “Expensive” recommendation on the stock at the current price of $0.235

VAH Daily Chart (Source: Thomson Reuters)

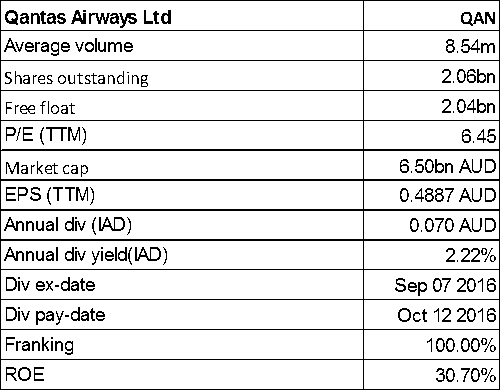

Qantas Airways Limited

QAN Details

QAN Transformation program:Qantas Airways Limited (ASX: QAN) in FY 16 has reported 57% increase in the underlying profit before tax to $1.53 billion and the 24% increase in the statutory earnings per share to 49.4 cents. Additionally, QAN transformation program has to unlock the total cost and revenue benefits of a further $450 million in FY 17 to reach the QAN’s increased target of $2.1 billion by 30

th June 2017. QAN has cut thousands of jobs, deferred aircraft orders and dropped unprofitable routes as part of the transformation program.

.png)

FY 16 Financial Performance (Source: Company Reports)

QAN otherwise announced the first dividend since 2009 and handed bonuses to 25,000 workers.

The international business has been decent while domestic business has been under scrutiny with mixed outlook by the market.On the other hand, QAN stock fell over 22.96% in the last six months (as of September 21, 2016) and we believe the headwinds might continue. Accordingly, we give an “Expensive” recommendation on the stock at the current price of $3.18

QAN Daily Chart (Source: Thomson Reuters)

Flight Centre Travel Group Ltd

.png)

FLT Details

Ongoing focus on expanding business:Flight Centre Travel Group Ltd (ASX: FLT) has acquired a minority interest (49%) in the Gold Coast-based Ignite Travel Group to further diversify its Australian sales network by investing in an emerging travel business specializing in the development and distribution of innovative leisure market models. Additionally, in FY 16, FLT’s TTV grew 9.7% to $19.3 billion and the revenue grew 11.2% to $2.7 billion.

.png)

FY 16 Financial Performance (Source: Company Reports)

However, the underlying profit after tax fell 3.8% to $246.7 million due to airfare price war leading to airfare price decrease by 4% during the second half, high capex due to the network upgrades, underperformance in some regions, particularly India, UAE and Asia, and EBIT loss of $7million on start-up businesses.

In addition, FLT has also incurred an unforeseen $3 million loss on forward exchange contracts and accordingly the stock fell 18.7% in the last six months (as of September 21, 2016), and has a reasonable dividend yield and low P/E. We give a “Hold” recommendation on the stock at the current price of $35.54

FLT Daily Chart (Source: Thomson Reuters)

Webjet Limited

.png)

WEB Details

Loss from profit in FY 16: Webjet Limited (ASX: WEB) reported on a statutory basis, the loss after tax of $80.7 million in FY 16 as compared to the net profit after tax of $5.8 million in FY 15. This is mainly due to the impairment of goodwill of $96.5 million related to the acquisitions of Bengerang and Tandou. On the other hand, WEB reported 120% increase in revenue to $128.4 million.

.png)

FY 16 Financial Performance (Source: Company Reports)

As a result, WEB stock rose over 69.9% in the last six months (as of September 21, 2016), placing the stock at an unreasonable P/E. The stock otherwise has been added in S&P/AS2 200 index effective September 16, 2016 while the group announced for a strategic sourcing partnership with Thomas Cook. We give an “Expensive” recommendation on the stock at the current price of $10.99

WEB Daily Chart (Source: Thomson Reuters)

Air New Zealand Ltd

.png)

AIZ Details

Sold stake of Virgin Australia:Air New Zealand Limited (ASX: AIZ) has carried 1,175,000 passengers during the month of August 2016, which is an increase of 4.4% as compared to the corresponding period last year. Moreover, in FY 16 AIZ has reported a 42% increase in the profit after taxation to $463 million. The Board has awarded a Company Performance Bonus of up to $2,500 to 8,200 Air New Zealanders. On the other hand, AIZ has completed the sale of its 19.98% shareholding in Virgin Australia (VAH) to Nanshan Group, and now holds over 5.9% of VAH shares. In addition, AIZ expects the earnings before taxation for the full year 2017 to be in the range of $400 million to $600 million, which is not a major increase as compared to FY16.

Given the ongoing balance sheet pressure on the back of their dividends coupled with weak bottom line growth, we give an “Expensive” recommendation on the stock at the current price of $1.805

AIZ Daily Chart (Source: Thomson Reuters)

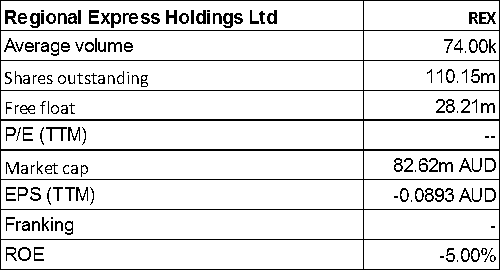

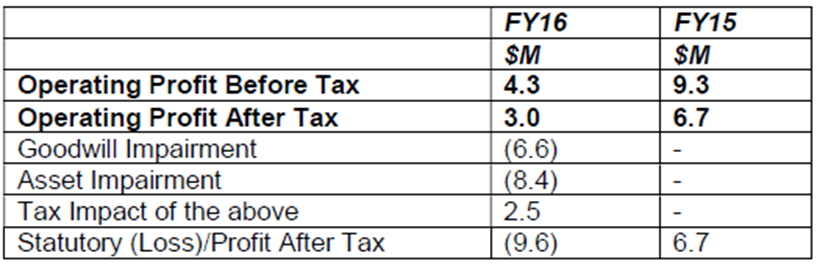

Regional Express Holdings Ltd

REX Details

Loss in FY 16: Regional Express Holdings Ltd (ASX: REX) reported the statutory loss after tax of $9.6 million in FY 16 after the $15 million impairment of goodwill and assets, and $4.3 million of operating profit before tax on a turnover of $261.9 million.

FY 16 Financial Performance (Source: Company Reports)

As a result, REX stock fell 1.95% in the last four weeks (as of September 21, 2016) while we give an “Expensive” recommendation on the stock at the current price of $0.75

REX Daily Chart (Source: Thomson Reuters)

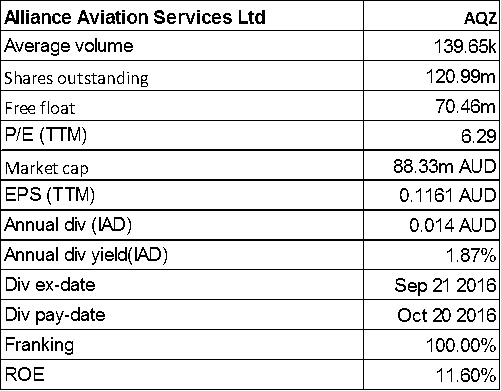

Alliance Aviation Services Ltd

AQZ Details

Strategic partnership agreement with Virgin Australia Holdings: Alliance Aviation Services Ltd (ASX: AQZ) and Virgin Australia Holdings Limited have signed a long-term strategic partnership agreement. Additionally, AQZ reported a statutory profit before tax of $13.5 million in FY 16 due to the continued cost control and diversification of revenue streams. The contract revenue is reduced due to fuel price. Net of fuel, the flying revenue has increased by 3.7%.

.png)

FY 16 Financial Performance (Source: Company Reports)

The acquisition of the Austrian Airlines Fokker fleet in November 2015 has positioned AQZ to get significant revenue opportunities from aircraft and spare part sales together with wet and dry leasing opportunities in a number of countries. On the other hand, the group reported a statutory net loss of $36.6 million in FY15.

Meanwhile, AQZ stock rose over 48.98% in the last three months (as of September 21, 2016) placing the stock at unreasonable levels. Accordingly, we give an “Expensive” recommendation on the stock at the current price of $0.735

AQZ Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.